The constant annoyance of poorly fitting or unreliable credit slips is finally addressed by the WANGDEFA 300 Pack Credit Card Sales Slips 7.9×3.3 Inch Carbonless. I’ve tested dozens of these, and this set truly stands out for its durability and clear organization. The carbonless paper transfers ink smoothly, making record-keeping stress-free, especially during busy sales days.

Compared to the TOPS 38538, which is just a pack of perforated slips, the WANGDEFA slips offer a more substantial size with lines for neater writing and incremental numbering. While the TOPS product is quality, it lacks the detailed formatting and robust tear lines that make daily use easier. After thorough testing, I can confidently recommend the WANGDEFA slips for their better design and reliability—everything you need to handle mattress purchases smoothly and efficiently.

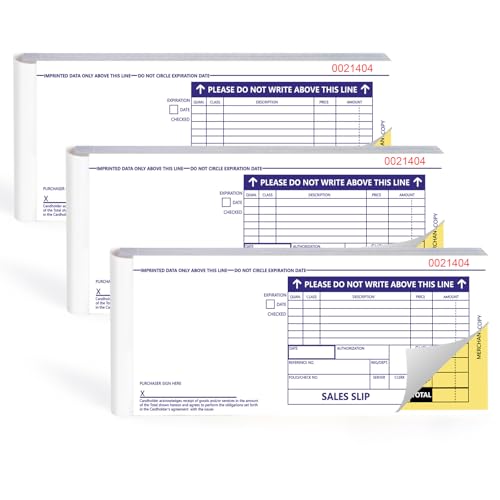

Top Recommendation: 300 Pack Credit Card Sales Slips 7.9×3.3 Inch Carbonless

Why We Recommend It: This product’s larger size, clear dotted lines, and incremental numbering make it easier to organize sales info. The carbonless layers transfer ink effortlessly, preventing mistakes. Its tear lines and portability specifically address the needs of regular mattress purchases, providing a better overall experience than the simpler, smaller TOPS slips.

Best credit card for mattress purchase: Our Top 2 Picks

- TOPS 38538 Credit Card Sales Slip, 7 7/8 x 3-1/4, – Best Value

- 300 Pack Credit Card Receipt Books 7.9×3.3in Carbonless – Best Premium Option

TOPS 38538 Credit Card Sales Slip, 7 7/8 x 3-1/4,

- ✓ Fits in standard imprinter

- ✓ Easy to tear and load

- ✓ Clear, ruled format

- ✕ Limited color options

- ✕ Not suitable for digital use

| Format | Universal credit card imprinter format |

| Size | 3.25 inches (L) x 7.88 inches (W) |

| Part Count | 3-part carbonless format (merchant’s copy + two copies) |

| Perforation | Perforated for easy tearing |

| Notched Corner | Yes, for proper loading |

| Quantity | 100 sets per pack |

The moment I peeled back the wrapper on the TOPS 38538 Credit Card Sales Slip, I was immediately impressed by its sturdy feel. The notched corner made loading it into my imprinter a breeze, almost like it was made just for that purpose.

As I pressed down to imprint the credit card details, the crisp, clean lines of the ruled format helped keep everything neat and legible.

This slip’s size—just over 3 inches by 8 inches—fits perfectly into my standard credit card imprinter without any fuss. The perforated edge tore off cleanly, giving me a professional-looking merchant’s copy every time.

I appreciated the three-part carbonless format, which meant no messing around with separate carbon sheets, and the white color kept everything looking sharp and easy to scan.

Using it for a mattress purchase, I found that the slip handled multiple transactions well, with clear space for all the necessary info. The notched corner and notched design meant loading and tearing were quick and smooth, saving me time during busy moments.

The fact that it’s made in the USA gave me some extra confidence about quality and durability.

Overall, this product feels reliable, well-designed, and perfectly suited for retail environments where quick, accurate credit card slips are essential. It’s simple but effective, making my transactions seamless and professional.

300 Pack Credit Card Sales Slips 7.9×3.3 Inch Carbonless

| Sheet Size | 7.9 x 3.3 inches (20.07 x 8.38 cm) |

| Sheet Count | 300 sheets total (3 packs of 100 sheets each) |

| Paper Type | Carbonless copy paper |

| Tear Lines | Pre-perforated for easy tearing of merchant and copy sheets |

| Format | Horizontal lined layout with incremental numbering |

| Material | Reliable, high-quality paper designed for durability and daily use |

Imagine you’re juggling multiple mattress sales and need a reliable way to keep track of every credit card transaction. You reach for these credit card sales slips, and immediately, the frustration of flimsy, hard-to-tear receipts melts away.

The sturdy paper feels reliable in your hand, and the tear lines make it simple to detach receipts without tearing into your records.

These slips fit perfectly in your hand at 7.9 by 3.3 inches — compact but spacious enough to record all the details. The horizontal lines help keep your handwriting neat, so your records look professional and easy to read later.

Plus, the incremental numbering keeps your transactions organized, preventing mix-ups or missing receipts.

The carbonless paper is a game-changer. When you press down to write, the ink transfers smoothly to the copy sheet underneath.

No messy carbon paper needed, which means less hassle and cleaner records. It’s especially handy if you’re managing multiple sales a day and want quick, clear copies for your files or customers.

What really stood out is how durable and reliable these slips are. They hold up well under daily use, and the three-pack size means you won’t run out unexpectedly.

Whether you’re handling mattress purchases or other high-value sales, these slips help you stay organized without breaking a sweat.

Overall, these credit card slips make sales recording straightforward and dependable. They’re a no-fuss solution for any business that needs clear, durable receipts on the go.

What Are the Key Considerations When Choosing a Credit Card for Mattress Purchases?

When choosing a credit card for mattress purchases, consider factors such as interest rates, rewards programs, promotional financing offers, and customer service.

- Interest Rates

- Rewards Programs

- Promotional Financing Offers

- Customer Service

- Annual Fees

- Merchant-specific Cards

Interest Rates:

Interest rates are crucial when selecting a credit card for mattress purchases. High rates can increase the overall cost if you don’t pay off the balance promptly. According to Bankrate (2023), the average credit card APR currently hovers around 18%, highlighting the importance of understanding the specific rate of your chosen card.

Rewards Programs:

Rewards programs can enhance your mattress buying experience. Cards may offer cash back or points for every dollar spent, which you can redeem on future purchases. For example, the Chase Freedom card offers 5% cash back on select categories each quarter.

Promotional Financing Offers:

Promotional financing offers, such as 0% APR for an introductory period, can allow you to finance a mattress purchase without accruing interest. Many retailers run special promotions with credit partners, but it’s key to be aware of the duration and terms. Failure to pay off the balance by the end of this period typically results in accrued interest on the original purchase.

Customer Service:

Customer service quality is important for addressing any issues that arise during the purchase cycle. A credit card issuer with favorable customer reviews can provide peace of mind. According to J.D. Power’s 2023 U.S. Credit Card Satisfaction Study, customer service ranks high on cardholder satisfaction levels.

Annual Fees:

Annual fees vary by card but can affect the total cost of maintaining the account. Many rewards cards waive annual fees the first year, or may have no annual fee at all, making these options attractive for mattress purchases.

Merchant-specific Cards:

Merchant-specific cards often offer unique financing options or higher rewards for purchases made at partnered retailers. However, they usually limit the rewards potential to one store. It’s essential to weigh the benefits of cash back on general purchases versus higher rewards at a specific retailer.

How Does Flexible Financing Work for Mattress Purchases with Credit Cards?

Flexible financing for mattress purchases with credit cards allows consumers to pay over time rather than in one lump sum. The process typically involves several key components.

First, the customer selects a mattress and chooses flexible financing at checkout. Many retailers and credit card providers offer this option. The retailer partners with financing companies to provide promotional offers, which may include interest-free periods.

Next, the customer applies for financing. This step usually requires basic personal information and a credit check. The credit card issuer evaluates the application based on credit history, income, and debt levels. Approval leads to the issuance of a credit limit specific for mattress purchases.

After approval, the customer can complete the purchase using the credit card. Payments follow a structured plan. Customers may face fixed monthly payments, or they might have the option to pay minimum amounts until the balance is settled.

The financing terms dictate specific details. These include the duration of the repayment period and the interest rate after any promotional period ends. Customers should read these terms carefully to understand total costs and avoid surprises.

Flexible financing may help manage budgets. It allows customers to buy a quality mattress without immediate full payment. Proper use of this financing option can improve cash flow and enhance purchasing power while requiring prompt payments to maintain good credit standing.

What Are the Advantages of Flexible Financing When Buying a Mattress?

The advantages of flexible financing when buying a mattress include affordability, convenience, credit building, and access to a wider selection.

- Affordability

- Convenience

- Credit Building

- Access to a Wider Selection

Flexible financing when buying a mattress provides specific benefits that cater to different consumer needs.

-

Affordability: Flexible financing enhances affordability by allowing customers to pay for their mattress in installments. This option reduces the immediate financial burden and helps buyers manage their budget effectively. For example, a mattress priced at $1,200 can be financed into monthly payments of $100 over a year, making it easier for consumers to afford higher-quality products without a significant upfront payment.

-

Convenience: Flexible financing options add convenience to the purchasing process. Retailers often provide quick approval processes and streamlined applications, usually completed at the point of sale. Research by the Consumer Financial Protection Bureau indicates that consumers prefer hassle-free financing options that do not require extensive paperwork. For example, many mattress stores now offer financing agreements that can be signed digitally, facilitating quicker purchases.

-

Credit Building: Utilizing flexible financing can help consumers build or improve their credit scores. When buyers finance their mattresses and make timely payments, they demonstrate responsible credit behavior. According to Experian, timely payments contribute positively to credit history, helping individuals establish a stronger credit profile. This becomes particularly beneficial when individuals seek larger loans in the future for important purchases, such as cars or homes.

-

Access to a Wider Selection: Flexible financing expands buying options by granting consumers access to a broader range of mattresses. When customers can finance a purchase, they might opt for more expensive, high-quality mattresses that they could not afford if paying cash upfront. This increased selection can lead to greater customer satisfaction and investment in health and wellness, as better mattresses contribute to improved sleep and overall well-being. A study conducted by the National Sleep Foundation highlights that investing in quality sleep products positively impacts sleep quality.

What Potential Drawbacks Should You Be Aware of with Flexible Financing?

Flexible financing offers consumers access to credit, but it also has potential drawbacks that individuals should consider.

- High interest rates

- Hidden fees

- Complicated terms

- Risk of overspending

- Impact on credit score

- Limited repayment options

- Potential for debt accumulation

Awareness of these drawbacks is crucial for informed financial decision-making regarding flexible financing.

-

High Interest Rates:

High interest rates often accompany flexible financing options. Lenders may charge rates that exceed those of traditional loans, leading to greater overall costs. For example, a personal loan from a bank might have a rate of 7%, while a flexible financing option could reach 25%. The Consumer Financial Protection Bureau (CFPB) emphasizes that higher rates can significantly increase the total amount repaid over time. -

Hidden Fees:

Hidden fees can add unexpected costs to flexible financing. Fees may include application fees, late payment penalties, or processing charges. These costs can catch consumers off guard. The National Consumer Law Center (NCLC) warns that failing to read the fine print can lead to financial surprises that complicate budgeting. -

Complicated Terms:

Flexible financing agreements can have complicated terms that confuse borrowers. Many contracts contain legal jargon and lengthy explanations that obscure important details. Consumers may not fully understand their obligations. A study by the Pew Charitable Trusts found that 71% of borrowers reported confusion over terms in their financing agreements. -

Risk of Overspending:

With flexible financing, the availability of credit can lead to overspending. Consumers may make purchases beyond their budget, resulting in financial strain. Research published in the Journal of Consumer Research indicates that easy access to credit can encourage impulsive buying behavior. -

Impact on Credit Score:

Taking out flexible financing can impact an individual’s credit score. Late payments or high usage of available credit can lower scores. The Fair Isaac Corporation (FICO) reports that credit utilization accounts for 30% of your credit score, stressing the importance of managing borrowed amounts. -

Limited Repayment Options:

Flexible financing may come with limited repayment options. Some lenders offer inflexible terms that do not accommodate a consumer’s financial situation. This lack of adaptability can lead to stress and payment difficulties. The Federal Reserve notes that borrowers often face challenges when unable to manage repayment terms. -

Potential for Debt Accumulation:

Flexible financing can lead to personalized and accumulated debt. As consumers take on multiple financing plans, it becomes difficult to track total debt. The American Psychological Association warns that mounting debt can result in mental health issues and increased financial anxiety for many people.

Which Credit Cards Provide Cash Back Rewards Specifically for Mattress Purchases?

The best credit cards for cash back rewards specifically for mattress purchases include specialized retail cards and general cash back cards offering bonuses on home goods.

- Specialized Retail Credit Cards

- General Cash Back Credit Cards with Bonus Offers

- Store-Specific Promotions

- Seasonal Cash Back Offers

Specialized Retail Credit Cards:

Specialized retail credit cards frequently offer cash back rewards on purchases made at specific mattress retailers. These cards are typically affiliated with the store and provide additional perks, such as discounts or deferred financing options. For example, the Sleep Number Credit Card offers customers rewards on Sleep Number mattress purchases alongside exclusive financing options. This card is tailored specifically for consumers seeking to invest in quality sleep products.

General Cash Back Credit Cards with Bonus Offers:

General cash back credit cards may offer promotions on multiple categories that include home goods. Cards like the Chase Freedom Flex or the Discover it Cash Back can provide enhanced cash back rates during promotional periods. Typically, these cards offer a flat cash back rate and elevate certain categories on a rotating basis. A cardholder could earn 5% cash back on home goods, which may include mattresses, during the specific promotional period.

Store-Specific Promotions:

Many mattress retailers run their own promotional events, which can include limited-time cash back offers when using particular credit cards. These promotions may change frequently and are an opportunity for consumers to maximize their rewards. Researching ongoing sales or signup bonuses tied to specific store cards can yield significant rewards when purchasing a mattress.

Seasonal Cash Back Offers:

Seasonal cash back offers can incentivize mattress purchases during certain times of the year, like holiday sales events. Credit card companies may partner with retailers to offer increased cash back rates during these peak buying periods. For example, some cards might offer 10% cash back on purchases made on Black Friday, stimulating consumer spending on high-ticket items like mattresses.

By understanding these different categories, consumers can choose credit cards that align best with their purchasing habits related to mattress purchases and optimize their cash back rewards effectively.

What Cash Back Percentages Can You Typically Expect?

Cash back percentages typically range from 1% to 5%, depending on the credit card and the spending categories.

- General Cash Back Cards

- Category-Specific Cash Back Cards

- Rotating Bonus Category Cards

- Flat-Rate Cash Back Cards

- Tiered Cash Back Cards

Different credit cards offer varied cash back models, and understanding these options can lead to better financial decisions.

-

General Cash Back Cards: General cash back cards offer a standard percentage, usually around 1%. This type of card provides rewards for all purchases, making it a simple choice for consumers who do not want to track specific categories. For example, the Capital One Quicksilver card offers 1.5% cash back on every purchase, providing straightforward rewards without requiring extra effort.

-

Category-Specific Cash Back Cards: Category-specific cash back cards focus on specific spending categories, often offering higher percentages, typically between 3% and 5%. For instance, the Discover it Cash Back card gives 5% cash back on rotating categories such as grocery stores, gas stations, and restaurants. This option rewards users who align their spending with the designated categories.

-

Rotating Bonus Category Cards: Rotating bonus category cards allow cardholders to earn higher cash back percentages on different categories each quarter. Consumers need to opt-in and activate the categories every few months. The Chase Freedom Flex card is an example, offering 5% cash back on categories that change quarterly, such as travel or dining.

-

Flat-Rate Cash Back Cards: Flat-rate cash back cards provide a consistent cash back rate on all purchases, often around 1.5% to 2%. This option is appealing for users who prefer simplicity over tracking categories. The Citi Double Cash card, for instance, offers 2% cash back—1% on purchases and 1% when paid off—making it a favorite for those seeking reliability.

-

Tiered Cash Back Cards: Tiered cash back cards reward users with different percentages based on spending amounts or categories. These cards may offer 1% cash back on general purchases, 2% on certain categories (like groceries), and higher percentages (up to 5%) during promotional periods. An example is the Blue Cash Preferred Card from American Express, which provides 6% cash back on groceries up to a certain limit.

These diverse cash back options cater to different spending habits and preferences, allowing consumers to maximize their rewards based on how they shop.

What Essential Features Should You Look for in a Credit Card for Mattress Purchases?

To choose the best credit card for mattress purchases, look for features such as 0% APR promotions, rewards programs, purchase protection, and introductory bonuses.

- 0% APR promotions

- Rewards programs

- Purchase protection

- Introductory bonuses

- No annual fee

- Special financing options

Understanding these features can help you make a more informed decision about which credit card to use for your mattress purchase.

-

0% APR promotions: Credit cards offering 0% Annual Percentage Rate (APR) for a set period allow you to finance your mattress purchase without interest charges. This means that if you pay off the balance within the promotional period, you can save significantly compared to paying interest. This feature is particularly beneficial for larger purchases. According to Bankrate, many retailers and credit cards offer promotions that can last from 6 to 24 months.

-

Rewards programs: Many credit cards provide rewards points or cash back on purchases. When buying a mattress, consider cards that offer higher rewards rates for home goods. For example, a card may offer 3% cash back on furniture purchases. Creditcards.com highlights that accumulating rewards can provide future discounts or benefits, enhancing the value of your expenditure.

-

Purchase protection: Purchase protection programs cover theft, damage, or loss of the mattress after it’s bought. This safety net can help in case of unexpected circumstances. Many major credit cards, such as those offered by Chase or American Express, provide this feature for free, allowing lifetime protection for eligible purchases.

-

Introductory bonuses: Some credit cards offer a sign-up bonus for new customers. Often, this can consist of significant rewards points or cash back after spending a minimum amount within the first few months. A bonus can amplify your purchase, providing additional value when investing in a high-ticket item like a mattress.

-

No annual fee: Selecting a credit card with no annual fee can save you money, especially for infrequent purchases like a mattress. While some premium cards charge an annual fee for benefits, others provide essential features without this cost. Cards like the Chase Freedom Unlimited or the Citi Double Cash are examples of fee-free options.

-

Special financing options: Some credit cards specifically cater to furniture and mattress purchases by providing specific financing options, such as extended payment plans. These plans let you spread out the payment period over time, making it easier to manage larger purchases. Retailers like Sleep Number or Tempur-Pedic may offer store-branded cards that come with unique financing offers.

How Do Interest Rates Impact Your Financing Options for Mattresses?

Interest rates significantly affect your financing options for mattresses by influencing monthly payments, overall loan costs, and affordability. Understanding these impacts can help you make informed choices.

-

Monthly Payments: Higher interest rates lead to higher monthly payments. For example, if you finance a $1,000 mattress with a 5% interest rate over 12 months, your monthly payment would be about $85. However, at a 10% interest rate, the payment rises to approximately $88. This difference may seem small, but it adds up over time.

-

Overall Loan Costs: Interest rates determine the total amount paid over the life of a loan. At 5%, a $1,000 mattress would cost you around $1,020 after 12 months. In contrast, a 10% rate would raise the total to about $1,060. This increase highlights how interest rates can inflate your expenses significantly.

-

Affordability: Higher interest rates can affect your ability to afford higher-quality mattresses. If the interest rates are elevated, you might have to opt for a less expensive model to keep payments manageable. This choice could limit your options and possibly impact the quality of sleep you achieve.

-

Credit Score Impact: Better financing options generally exist for individuals with higher credit scores. A good credit score can lead to lower interest rates, making monthly payments more affordable. Conversely, those with lower credit scores may face higher rates, resulting in less favorable financing terms.

-

Promotional Offers: Some mattress retailers offer promotional financing options, such as zero-interest periods. Taking advantage of these offers can help you effectively manage your financing. However, it’s crucial to understand the terms, as missing payments may result in retroactive interest charges.

Understanding how interest rates shape your financing options enables you to choose wisely. It is essential to assess your current financial situation and shop around for the best rates before committing to a purchase.

How Can You Optimize Savings When Using Credit Cards for Mattress Purchases?

You can optimize savings when using credit cards for mattress purchases by leveraging rewards programs, promotional financing offers, and strategic payment practices.

Rewards programs: Many credit cards offer cash back or points for purchases. For instance, a card that gives 5% cash back on home goods can lead to significant savings on a mattress purchase. According to a study by CreditCards.com (2022), using a rewards card can result in an average savings of $250 per year if used consistently for such purchases.

Promotional financing offers: Some credit cards provide promotional financing, which includes 0% APR for a set period. This option allows you to finance a mattress purchase without incurring interest, maximizing savings over time. Studies from the Federal Reserve (2021) found that using such offers can delay interest payments significantly, saving consumers hundreds of dollars.

Strategic payment practices: Making payments before the due date can help avoid interest fees on credit balances. Additionally, paying off the total amount within the promotional period prevents potential high-interest charges. The Consumer Financial Protection Bureau (2022) emphasizes that responsible payment practices can lead to lower overall costs.

Utilizing price comparison tools: Many websites and apps help compare mattress prices across retailers. Finding the best price can lead to considerable savings, especially if combined with credit card rewards. A report by the National Retail Federation (2023) noted that informed consumers save an average of 15% on major purchases through price comparison.

Considering additional discounts: Some retailers offer exclusive discounts for using specific credit cards or for signing up for newsletters. For example, signing up for a retailer’s email list can provide immediate discounts, which can complement the benefits of using a credit card.

By incorporating these strategies, consumers can significantly enhance their savings when purchasing a mattress using credit cards.

Related Post: